I’m not really certain what it was written for, but I remember the big letters on a slip of paper: IOU.

Maybe I’d borrowed a few dollars from a friend. Maybe a teacher had loaned me a pencil and wanted it back. My memory is pretty good, but it’s not perfect. Clearly my spelling and grammar still needed some work too. But the idea itself was clear enough. An IOU. An I owe you.

That simple concept is the building block on which our entire monetary system is built: debt.

That idea came roaring back recently during a conversation with my son about Scott Galloway’s notion of men creating “surplus value.” I haven’t read the book, but I’ve listened to enough interviews to understand the point. Give more than you take. Produce more than you consume. Contribute something of value that didn’t exist before you showed up.

In monetary terms, creating surplus value means that someone owes you something. That “something” is what money was meant to represent in the first place.

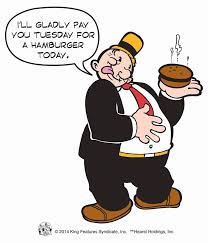

Pulling in the opposite direction is J. Wellington Wimpy from Popeye the Sailor Man. His immortal line was that he would “gladly pay you Tuesday for a hamburger today.” Wimpy isn’t interested in surplus value. He’s interested in the now. He wants the benefit immediately and pushes the obligation off into the future. That’s credit. Getting before you’ve given. Consumption untethered from contribution.

Between those two simple ideas—IOU and Wimpy—there’s a lot to be learned about what money actually is, and how far we’ve drifted from its original purpose.

Money was meant to be a systemic IOU. A marker that you had already provided goods or services to someone else. You could then pass that IOU along to another person in exchange for what you needed. If you consistently created surplus value in the world, you accumulated surplus money. If you didn’t have enough in the moment, you could borrow—paying a premium in interest for the privilege of consuming before contributing.

On a small scale, the logic is intuitive and fair. You mow a lawn. You teach a class. You fix a car. Value is created. An IOU is issued. Trust is maintained.

As the scale expands, things get murkier. Someone like Howard Schultz, for example, has created surplus value that touches millions of lives every day. Jobs, products, routines, communities. Quantifying that impact is difficult, but few would argue that it exists. The system is supposed to reward that kind of value creation proportionally.

Where the tension really shows up is at the national level.

Our government has repeatedly devalued our collective IOUs while playing Wimpy on the international stage. Promising Tuesday. Borrowing endlessly. Printing claims on value that hasn’t yet been created—and may never be. When that happens, the IOUs held by ordinary people quietly lose meaning. The surplus value they worked to create gets diluted, siphoned off, and often frittered away.

It becomes harder and harder for the average person to get ahead, not because they aren’t producing value, but because the measuring stick keeps shrinking. You can do everything “right” and still feel like you’re running uphill on loose gravel.

Money, at its core, is a story we agree to believe. An IOU that says, I have contributed, and I will be able to draw from that contribution later. When that story breaks down—when IOUs are issued faster than value is created—the trust erodes. And without trust, the paper is just paper.

Maybe that’s why that old slip with “IOU” written on it sticks with me. It wasn’t just about owing someone a pencil. It was a lesson, early and imperfect, about responsibility, reciprocity, and keeping your word.

Tuesday eventually comes. The question is whether the hamburger ever gets paid for.

Be valuable today!

Pete